ADvTECH Limited

(Incorporated in the Republic of South Africa)

(Registration number 1990/001119/06)

Share code: ADH ISIN: ZAE000031035

(“the Company” or “ADvTECH” or “the Group”)

VOLUNTARY BUSINESS UPDATE AND FEEDBACK FROM THE BOARD MEETING RESULTING IN AMENDMENT TO SPECIAL RESOLUTION 1 TO BE TABLED AT THE AGM ON 28 MAY 2020

Overview

ADvTECH achieved a 10% increase in enrolments for 2020 compared to the prior year with both Schools and Tertiary divisions experiencing good growth. This, together with the efficiency improvements achieved in the Schools division, and with a solid performance by the Resourcing division, resulted in the Group delivering a strong financial performance for the first quarter to 31 March 2020. This level of performance, however, will not be sustainable for the remainder of the year as a result of impact of the national lockdown on the economy.

ADvTECH continues to monitor the ongoing regulatory environment and we are preparing for various scenarios for re-opening our schools and tertiary institutions. Our readiness plans are advanced. We have drawn on local and global best practise on how to open our schools in a responsible manner.

Our duty remains the provision of the highest quality education, across all educational divisions, in such a way that students are all able to participate and benefit, while remedial and ameliorative actions have been instituted for those not able to participate optimally. A key component of our online offering lies in pastoral care, where the pastoral care teams set up at each school ensure that our parents and students receive ongoing guidance, support and nurturing on an individual basis.

We transitioned to a full online offering at the beginning of the lockdown. Our focus has been to ensure that staff and students have the best remote working and learning experience. Because we have leveraged off our existing licences, we were able to scale to meet demand for more users, without having to incur significant capital expenditure.

Collections were circa 20% lower in April compared to the same month last year - with a shortfall of collections of approximately 30% in the Tertiary division and 10% in the Schools division. While collections continue to be challenging, month-to-date collections for May are 10% below the same month last year, with both the Tertiary and Schools division’s showing a reduced shortfall compared to April 2020. We have instituted individualised interventions to support those who have been negatively impacted as a result of the lockdown. To date, at a cost of R24 million, ADvTECH has assisted 5 386 families, whose ability to pay full school fees was impacted by COVID-19.

In the rest of Africa, the Group has adopted a similar policy as in South Africa. We have implemented on-line programmes to support continuous education. However, the adoption rates are lower than in our schools in South Africa - although there are signs that this is improving.

Currently, to a large extent, we have been able to cushion most of our employees and stakeholders from any major impact as a result of the lockdown. We have, however, had to implement stronger action in our Resourcing division where business activity has been reduced dramatically owing to the downturn in economic activity.

Schools

We are finalising preparations for a phased return as of 01 June 2020 while also continuing to offer online teaching to those students that are not ready to return to the classroom. The relevant protocols and necessary equipment are in place and our schools are ready to receive our students. The safety of our employees, learners, and students and staff is our primary concern.

We’ve had average attendance of 95% on our online classes. Our staff have received positive feedback on the quality of the programme and their engagement levels, to the extent that we have witnessed some new intakes during lockdown. Unfortunately, we have also experienced some leavers particularly in the lower grades where more parent supervision is needed, and in some instances where it is no longer affordable for parents.

Tertiary

For a number of years, we have been applying the use of some online learning in campuses to supplement face-to-face learning. This has prepared our faculty to deliver in a digital environment and allowed for a seamless transition to our online offering.

Our more than 40 000 campus-based students have transitioned to an integrated learning management system, with quality assurance and accreditation for all our qualifications. Low data requirements are standard for our solutions. Students were also provided with data and reverse billing to enable access to learning material and engagement.

We have found lower levels of engagement in the tertiary institution than at the schools, as more discretion can be applied at a tertiary level. As we begin to transition back to contact classes from the beginning of June, these students will be our priority. We want to avoid as many as possible from foregoing the academic year. Additional, mid-year enrolments are unlikely to materialise and the dropout rate at the tertiary level is also likely to increase.

Resourcing

Recruitment activity reduced dramatically. The South African recruitment business has been severely affected by the pandemic, and the significant reduction in business activity has forced us to take stronger action in order to preserve cash.

We have had to introduce short-time and skeleton staffing arrangements to make payroll savings. We have also negotiated rental reductions and other cost savings with suppliers as we attempt to ensure that we can sustain the organisation through this very difficult period. These changes have been well planned and executed by the Resourcing management team. The cuts have been implemented across the board on a graduated basis to lessen the impact on the lower earning level employees.

The strategy of market and geographic diversity has proven to be valuable for the Resourcing division. Our rest of Africa operations have been relatively unaffected. We have continued normal operations and, to date, the results are very pleasing. Consequently, the combined Resourcing division remains viable despite the extreme difficulty faced in the South African market.

Financial update

Management has given due consideration to the effect that the COVID-19 pandemic could potentially have on the financial position of our business and its solvency and liquidity position. We have considered the business environment, the expected outcomes of the economic environment on our stakeholders, on fees and collections, as well as the capital expenditure needs of the Company in the short to medium term.

In addition to the revenue losses in the Resourcing division, we are experiencing losses on boarding fees, extramural and aftercare fees, as well as some de-registrations. While our business is mainly fixed cost based, we have worked tirelessly to curtail any discretionary costs and any variable costs which we can forego without harming the business and livelihood of all our stakeholders while also making use of the allowances available from Government. These include conferences, travel, cleaning, water and lights, printing and other consumables. These costs savings, however, will amount to far less than the lost revenue. While the immediate challenges need to be navigated, the aim and focus is relentlessly on ensuring ongoing organisational sustainability. We will incur some costs to make the schools safe and have all the necessary protective equipment in place.

We presented our sensitivity model to our Board to test different scenarios to inform our capital management plans, and have implemented a series of cash preservation measures, including curbing non-essential capex until visibility improves. The Group does not foresee spending more than R300 million in the current financial year on capex.

The cashflow impact is at this stage difficult to quantify, and while there is no doubt that this crisis will have a material impact on the Group’s earnings, our sensitivity analysis demonstrates that the Group has significant capacity to navigate this crisis within its existing facilities.

While the situation remains challenging, we believe that we have done the best with what is within our control, and the rollout of well thought out business continuity measures will allow us to continue to minimise the impacts. We have maintained a strong balance sheet, and our capital expenditure containment measures are sustainable.

The Board and management therefore remain satisfied that the Group has significant resilience to navigate this crisis within its existing facilities.

Board meeting outcomes

Dividend decision

Shareholders are advised that the Board has met to consider paying a dividend or a share buyback in lieu of dividends as advised in the annual results announcement published on SENS on 23 March 2020.

In the current environment and with the heightened level of uncertainty, the Board decided not to declare a final dividend for the financial year ended 31 December 2019 or to undertake a share buyback. The Board also do not consider that declaring an interim dividend for 2020 would be appropriate due to the lack of clarity on the economic outlook and the effect of COVID-19 on our business and operations over the medium term.

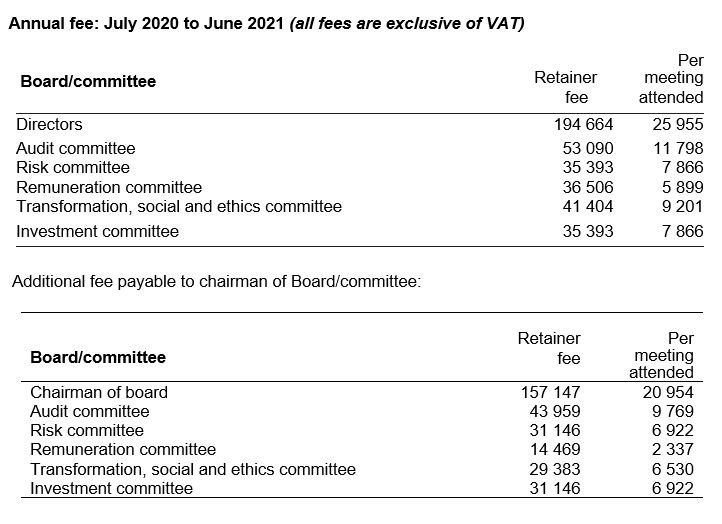

Amendment to Special Resolution 1: Non-executive directors’ fees

Considering the current financial environment and uncertainty, the Board has resolved that the fees payable to non-executive directors will not be adjusted for the period July 2020 to June 2021. Accordingly, the Company will no longer be asking Shareholders to adjust non-executive directors’ fees.

The Board has resolved to amend Special Resolution number 1 to read:

Section 66(8) (read with section 66(9)) of the Companies Act provides that, to the extent permitted in the Company’s MoI, the Company may pay remuneration to its directors for their services as such provided that such remuneration may only be paid in accordance with a special resolution approved by Shareholders within the previous two years.

These requirements are echoed in King IV and the JSE Listings Requirements. The Company’s MoI provides that the directors shall be paid such remuneration as determined from time to time by a general meeting.

After consultation between the Board and management, and notwithstanding feedback on the benchmarking of fees payable to non-executive directors, it is proposed that no increase in non-executive directors’ fees for 2020 be tabled at the AGM as the Company conserves cash owing to COVID-19; and that fees be payable quarterly in arrears for the period July to June of the following year.

Special resolution number one

“Resolved that the payment of the following fees to the non-executive directors for their services to the Company for the period 1 July 2020 to 30 June 2021, as well as any Value Added Tax (“VAT”) payable on such fees by directors be and is hereby approved, with a 20% premium being payable to non-resident non-executive directors:

The amendment of Special Resolution number 1 from the AGM does not affect the proxy form already submitted/or to be submitted in respect of other resolutions to be presented at the AGM.

If a Shareholder has already submitted voting instructions or forms of proxy, prior to the publication of this announcement, such voting instructions or forms of proxy will remain valid, unless the Shareholder submits new voting instructions or forms of proxy.

Closing

It is too early to offer any new financial guidance, as we will need greater certainty of the economic impact of COVID-19 on all our operations. What we can assess is that there is a general slowing in collections, and we expect debtors due to increase, which is likely to lead to increased bad debts and a greater level of provisioning for doubtful debtors, as well as some withdrawals due to financial hardship. The Group believes, however, that its business and brands are well positioned to continue to grow in the future, because more operating efficiencies can still be achieved.

For the past three months we have been working on our plans for our ADvTECH Online School concept, which we aim to launch in January 2021, and we have recently appointed our first online school principal.

We have learnt a great deal as a Group, developed new material and skill sets that will prove to be invaluable in the future. But what is most notable, is that the COVID-19 pandemic has provided the organisation with a valuable test and opportunity to develop our business in a post COVID-19 world.

Any forward-looking statements contained in this announcement have not been reviewed nor reported on by the Company’s auditors.

27 May 2020

Johannesburg

Sponsor: Bridge Capital Advisors Proprietary Limited