Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Our

Brands

Schools Division

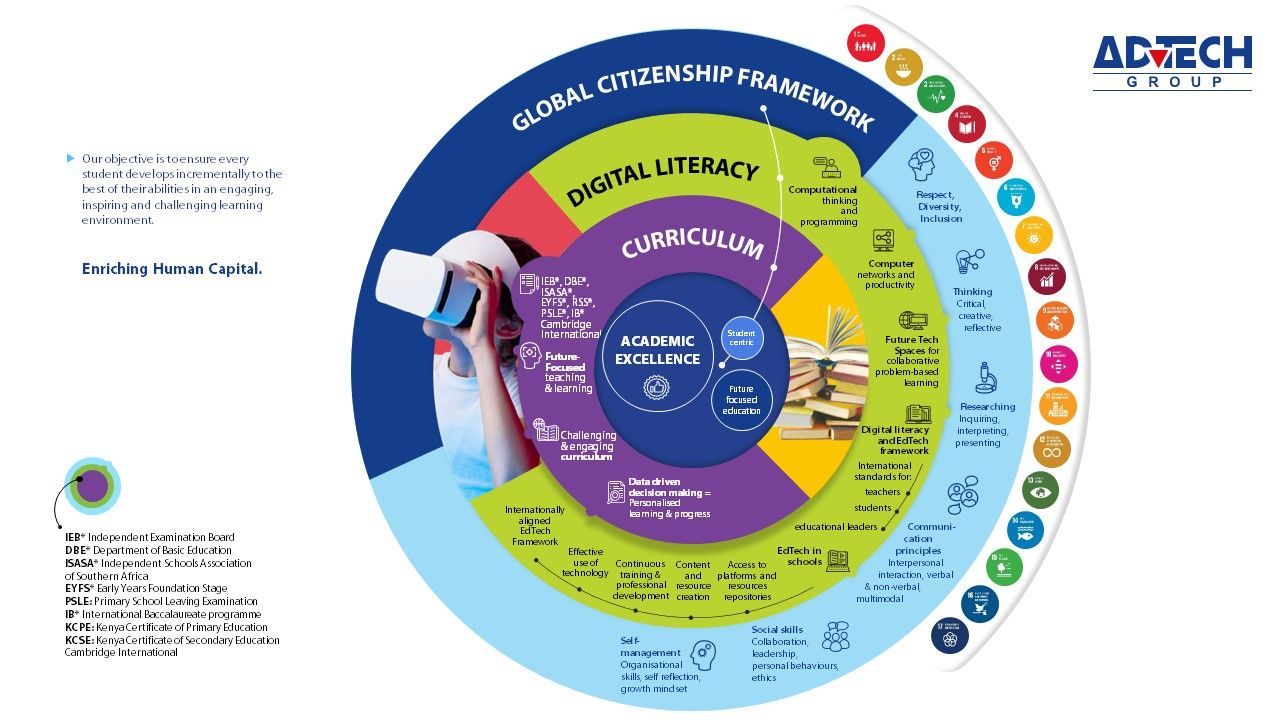

Academic Excellence

The core of our business

ADvTECH remains Africa's leading private education provider. Academic excellence is core to our strategy and has enabled us to continue growing our market share, despite the continuing increase of new entrants into the market.

Core to our strategies are:

EXCEPTIONAL TEACHING AND LEARNING

BENCHMARKING OUR PERFORMANCE

against others and relative to previous years of our own performance to ensure we are living out a continual improvement ethos and can provide evidence to support our claims of excellence.

LEARNING AND OTHER ANALYTICS

are used to support decision making.

INTERNATIONAL AND EMPLOYER RECOGNITION

requires the ongoing building of our reputation and relationships.

In the News

By Tamara Thomas

•

23 Apr, 2024

ADvTECH Limited (Incorporated in the Republic of South Africa) (Registration number 1990/001119/06) Share code: ADH ISIN: ZAE000031035 (“ADvTECH” or “the Company”) DEALINGS IN SECURITIES BY A PRESCRIBED OFFICER OF THE COMPANY In compliance with the JSE Limited Listings Requirements the following information is disclosed in respect of dealings in ADvTECH securities by an ADvTECH prescribed officer.

By Tamara Thomas

•

15 Apr, 2024

ADvTECH Limited (Incorporated in the Republic of South Africa) (Registration number 1990/001119/06) Share code: ADH ISIN: ZAE000031035 (“ADvTECH” or “the Company”) DEALINGS IN SECURITIES BY A DIRECTOR In terms of paragraphs 3.63 to 3.74 of the JSE Limited Listings Requirements (“JSE Listings Requirements”), the following transaction, in respect of which prior written approval pursuant to paragraph 3.66 of the JSE Listings Requirements have been obtained, is hereby disclosed.

By Tamara Thomas

•

27 Mar, 2024

ADvTECH, Africa’s leading private education provider, has pledged its support to Educor students left in the lurch after the college group was deregistered this week. “We stand by the Educor students and are committed to supporting them in successfully completing their qualification,” says Shevon Lurie, Director of The Independent Institute of Education, the higher education division of ADvTECH. Brands of The IIE include IIE Varsity College, IIE MSA, IIE Vega and IIE Rosebank College. “We understand the uncertainty and concern facing affected students. This is a regrettable and unfortunate development which will impact thousands, and as The IIE, we endeavour to help students registered for both the contact and distance modes of study to the best of our ability to ensure their academic journey is successful in future,” Lurie says. “As part of the ADvTECH group, our commitment is not only to our own students, but also to the sustainability, growth and development of higher education in South Africa as a whole.” Lurie says The IIE has set up a centralised process and will be channelling queries through the Registrar’s office to ensure students are quickly and correctly advised. Students will be accommodated as of Semester 2. Affected students who would like to enquire about their options of transferring to The IIE can mail registrar@iie.ac.za . The office will assist students with queries regarding similar qualifications, the nearest campus to consider, and the process for applying for academic credits. Each student’s financial circumstances and academic transcript will be holistically reviewed. Support for students will be assessed at an individual level given the variables at play. In general, the process ahead will be as follows: Transfer of courses The IIE will look for a similar qualification and NQF level in the chosen field of study, ensuring that the student also meets the admission criteria. Process The IIE will guide students through the necessary channels and steps to ensure they are fully informed. Given that we are already halfway through the first semester transfers will be facilitated for Semester 2. Transfer of credits The IIE will conduct an academic credit mapping exercise for each student. This will entail assessing the overlap between modules that the student has passed with similar modules on the transfer qualification. If there is sufficient alignment, an academic credit/s is granted and the student is exempt from the relevant module. Fee considerations Fee credits will be granted for module credits, i.e. the total programme fee will be reduced by the cost of the module/s that the students are granted academic credit for. “Our focus is to support former Educor students to successfully obtain their qualification, without extending their study period wherever possible,” says Lurie.